“Who made who? Ain’t nobody told you. Who made who, who made you? Who pick up the bill and who made who?” – AC/DC Who Made Who, 1986

Canada is a super-colony founded upon many myths and fables. The most popular legend amongst uninformed Canadians is that the original people – who we might call the Indians, the Onkwehonwe or the Anishnabek – do not pay tax, and have never paid tax.

Without getting into the reasons why indigenous people shouldn’t pay Canadian tax let’s first look at some of the other facts. Here’s one small example.

Onkwehonwe ironworkers from Six Nations each pay at minimum $20,000 a year into the Canadian coffers because their work is done off reserve and is therefore taxable, says the Canadian government.

Status Indians, according to the Indian Act of Canada, must pay GST on every single purchase that is bought off reserve when using a Status Card at the cash register. They are exempt from the PST portion. Then there is the humiliating moment spent filling out the paperwork and dealing with impatient Canadians tapping their feet while they wait in line.

A leakage study done in 2009 showed that Six Nations alone spent $75 million off reserve, in Ontario cities and towns such as Brantford, Caledonia, Hamilton and Hagersville. If a status card was used in each purchase then at least $600,000 in taxes were paid to an imposed foreign Canadian government that year.

Remember that the Six Nations were not conquered and their treaties with the Royal Monarch of England still apply by international law. But let’s move on.

What were things like in this continent one thousand years ago? If we take a look into the oral history it says that indigenous people paid a whopping 50% income “tax” to their government before the intrusion of the white man. But there are some major differences that need clarification.

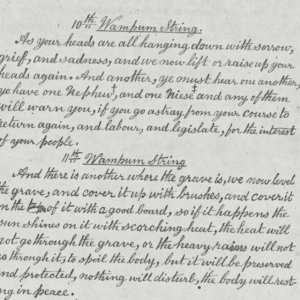

First of all, there was no form of debt or currency wthin indigenous society – all “taxes” involved food and trade goods. Although wampum has intrinsic value, it was not an ancient Indian coin.

Secondly, the common people were equal members of government in a non-hierarchal society so when they gave things to one another it could be considered a “tax”.

And finally they say that after the hunting season half of the meat would be gifted to the elderly, and disabled populations. Sometimes the entire hunt or the whole crop was given away which meant a 100% tax rate.

This form of taxation was done according to good conscience, or free will and could be considered a tribute of honour.

It is still this way in Six Nations society today. There is no law passed down by a great and mighty leader that the people must obey under threat of punishment. But because of the goodness within the hearts of the men and women the Six Nations people still help each other. They pay taxes to each other.

So when “Good Canadians” get into the comments section and start labelling indigenous people as freeloaders getting a free ride off their hard work let’s make one thing clear – it is ignorant, unabashed racism.

Actually the truth shows the state of affairs in Canada to be quite the contrary. Indigenous people have subsidized the growth of Canada from the very beginning, starting with indigenous blood freely flowing on the fields of Queenston Heights as the Six Nations repelled the American invaders October 13, 1812.

Then the Six Nations started the financing of many corporations such as the Canadian Railroad and the Grand River Navigation Company. On top of all of this we must factor in the billions of dollars that are being extracted from indigenous lands. Remember that only 1% of Canada has been lawfully settled.

In 2011 the Canadian government received 9 billion in taxes from mining companies alone. How can Canadians tax minerals that they do not own? The Indian Act is preventing ancient countries such as the Āhtawāpiskatowi ininiwak from asserting sovereignty over their own land.

This 9 billion should not go directly to Canada because it doesn’t own the land. This is the crux of the European problem. You can’t just take people’s stuff when they aren’t looking. It’s wrong – we teach our children that by age 3.

So we can see that indigenous people do pay tax but they are paying it to a foreign government – yet they are portrayed as welfare recipients. And furthermore they would pay taxes to their own governments if they had not been oppressed by legislation and prevented from carrying on their ancient nationalities.

Six Nations should have the funds available to them for the very best infrastructure in the world. Attawapiskat should have world class facilities from the billions of dollars worth of resources extracted from their unceded territory.

But the sad reality is that our international agreements are being dishonoured, indigenous peoples are paying taxes to the wrong governments and even the “Good Canadians” are treating us like bwoot.